Frequently Asked Questions (FAQ) of Deposit, Withdrawal and Trading in IQ Option

Deposit

How long does it take for the boleto I paid to be credited to my account?

Boletos are processed and credited to your IQ Option account within 2 business days. Please note that we have different boletos, and they usually vary only in the minimum processing time, being 1 hour for fast boletos and 1 day for the other versions. Remember: business days are only from Monday to Friday.

I paid a fast boleto and it didnt come into my account in 24 hours. Why not?

Please note that the maximum processing time for boletos, even the fastest, is 2 business days! Therefore, it means that there is only something potentially wrong if this deadline has expired. It is common for some to be credited quickly and others not. Please just wait! If the deadline has expired, we recommend contacting us via support.

How long does it take for the deposit I made by bank transfer to arrive in my account?

The standard maximum time limit for bank transfers is 2 business days, and it can take less. However, just as some boletos are processed in less time, others may need all the time of the term. The most important thing is to make the transfer on your own account and place a request through the website/app before making the transfer!

Whats this 72-hour error?

This is a new AML (anti-money laundering) system that we have implemented. If you deposit via Boleto, you must wait up to 72 hours before making a withdrawal. Note that the other methods are not impacted by this change.

Can I deposit using someone elses account?

No. All deposit means must belong to you, as well as the ownership of cards, CPF and other data, as stated in our Terms and Conditions.

What if I want to change the currency of my account?

You can only set the currency once, when you make the first deposit attempt.You will not be able to change the currency of your real trading account, so please make sure you choose the correct one before you click "Proceed to payment".

You can deposit in any currency and it will be automatically converted to the one you chose.

Debit and credit cards. Can I deposit via credit card?

You can use any Visa, Mastercard, or Maestro (with CVV only) debit or credit card to deposit and withdraw money, except for Electron. The card must be valid and registered in your name, and support international online transactions.

Where is my money? A deposit was made to my account automatically

IQ Option company is not able to debit your account without your authorization.Please make sure that a third party doesnt have access to your bank account or e-wallet.

Its also possible that you have several accounts on our website.

If theres any chance that someone got access to your account on the platform, change your password in the settings.

How can I unlink my card?

If you want to unlink your card, please click "Unlink Card" right under the "Pay" button when you make your new deposit.

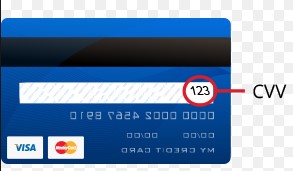

CVV or CVC code. What does CVV mean?

The CVV or СVС code is a 3-digit code that is used as a security element during online transactions. It is written on the signature line on the back side of your card. It looks like below

What is 3DS?

The 3-D Secure function is a special method for processing transactions. When you get an SMS notification from your bank for an online transaction, it means that the 3D Secure function is on. If you do not receive an SMS message, contact your bank to enable it.

I have problems depositing via card

Use your computer to deposit and it should work right away!Clear temporary internet files (cache and cookies) from your browser. To do this, press CTRL+SHIFT+DELETE, choose the time period ALL, and select the option to clean. Refresh the page and see if anything changed. For complete instructions, see here.. You can also try using a different browser or a different device.

Deposits might be declined if you entered the wrong 3-D Secure code (the one-time confirmation code sent by the bank). Did you get a code via SMS message from your bank? Please contact your bank if you didnt get one.

This might happen if the "country" field is empty in your information. In this case, the system doesnt know what payment method to offer, because available methods differ by country. Enter your country of residence and try again.

Some deposits might be declined by your bank if they have restrictions on international payments. Please contact your bank and check this information on their side.

Withdrawal

How long does it take for the withdrawal I made by bank transfer to arrive in my bank account?

The standard maximum time limit for bank transfers is 3 business days, and it can take less. However, just as some boletos are processed in less time, others may need all the time of the term.

Why did you change the minimum amount for bank transfer withdrawals to 150.00BRL?

This is a new minimum withdrawal amount for bank transfers only. If you choose another method, the minimum amount is still 4 BRL. This change was necessary due to the high number of withdrawals processed by this method at low values. In order to respect the processing time, we need to decrease the number of withdrawals made per day, without affecting the quality of the same.

I am trying to withdraw less than 150.00BRL by bank transfer and I get a message to contact support. Please arrange it for me.

If you want to withdraw an amount below 150 BRL, you only need to select another withdrawal method, for example electronic wallet.

What are the minimum and maximum withdrawal amounts?

We have no restrictions as to the minimum withdrawal amount — starting from $2, you can withdraw your funds on the following page: iqoption.com/withdrawal. To withdraw an amount less than $2, you will need to contact our Support Team for assistance. Our specialists will provide you with the possible scenarios.

How much can I withdraw per day from iqoption broker? Is there a limit?

You can withdraw up to $1,000,000 per day. The number of withdrawal requests is unlimited. The withdrawal request must not exceed the amount available on your account.

Do I need to provide any documents to make a withdrawal?

Yes. You need to verify your identity in order to withdraw funds. Account verification is necessary in order to prevent fraudulent financial transactions on the account.

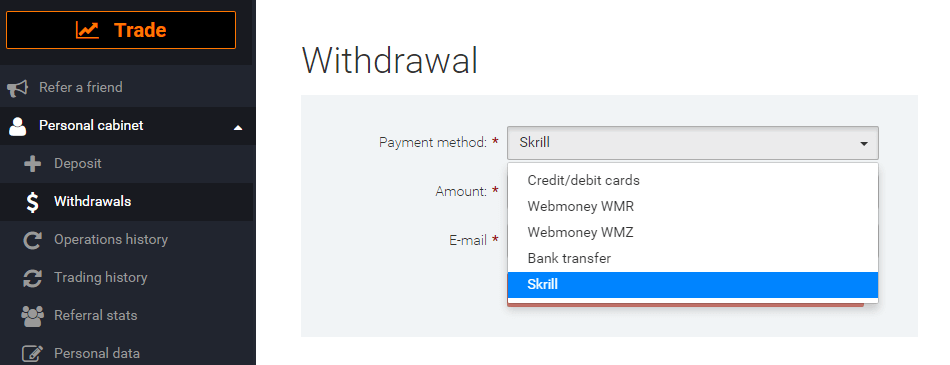

Sample of withdrawal

Example 1:Within the last 90 days you have deposited from your card $200 USD, you now have $250 on your balance. To withdraw it all you need to apply for two withdrawals: $200 to your bank card and $50 to your e-wallet (Skrill, Fasapay, Neteller etc) or use the wire transfer. Please be aware of the $50 fee, which banks take for the wire transfer, so this type of withdrawal is not the best one unless you withdraw more than $1000.

Example 2:

You have deposited $200 100 days ago, it means you now need to withdraw to the e-wallets, the card withdrawal is no more available because we only count 90 days from your last card deposit.

Example 3:

You have deposited from your bank card $200 and $100 from your e- wallet. You need to withdraw $200 to the bank card and then you will be able to withdraw to the e-wallet. Withdrawal to the bank card is prioritized (goes always first).

What is the recommended maximum and minimum withdrawal sum on IqOption?

There are no minimum withdrawal amounts – you can withdraw as low as $2 from iqoption. However, if you want to withdraw less than $2, then you must contact customer support for help. $1,000,000 is the maximum withdrawal amount.

How to create WebMoney e-wallet to receive money

1) Use this link to create your WebMoney account2) Enter your phone number and confirm it

3) Input your personal data

4) Verify phone number

5) Create a password

6) Pick a currency to create your wallet

7) Then make your deposit with e-wallet or bank card

This is a roundup of the charges for money transfer from your WebMoney account:

2-2.5% if you’re withdrawing with bank card.

1.5-3.5% if you’re withdrawing through bank wire transfer.

What is ARN?

The ARN (Acquirer Reference Number) is a special number used to tag transactions on a credit card from the merchant bank i.e. acquirer. through a card scheme, down to the issuer i.e. cardholder’s bank. Issuing banks use the number to track transactions with acquirers.You must always remember to make sure the ARN codes are submitted to the Processing Center of your bank (general client office employees are not always aware of the codes or how they’re used). If you’re unable to go to the Processing Center, you can get in touch with the bank officers in charge of processing card operations. They can help you track the money. Don’t forget to let them know that the transaction is not a new one but a refund.

How do I withdraw funds from the trading account to a bank card?

To withdraw your funds, go to the Withdraw Funds section. Choose a withdrawal method, specify the amount and other necessary details, and click the “Withdraw Funds” button. We do our best to process all withdrawal requests within the same day or the next day if outside working hours on business days (excluding weekends). Please note that it may take a little longer to process interbank (bank-to-bank) payments.The number of withdrawal requests is unlimited. The withdrawal amount should not exceed the current trading balance amount.

*Withdrawal of funds returns the money that was paid in the previous transaction. Thus, the amount that you can withdraw to a bank card is limited to the amount that you have deposited with that card.

Appendix 1 shows a flowchart of the withdrawal process.

The following parties are involved in the withdrawal process:

1) IQ Option

2) Acquiring bank – IQ Option’s partner bank.

3) International payment system (IPS) – Visa International or MasterCard.

4) Issuing bank – the bank that opened your bank account and issued your card.

Please note that you can withdraw to the bank card only the amount of your initial deposit made with this bank card. This means that you can return your funds to this bank card. This process may take a little longer than expected, depending on your bank. IQ Option immediately transfers the money to your bank. But it may take up to 21 days (3 weeks) to transfer money from the bank to your bank account.

If you do not receive the money on the 21st day, we kindly ask you to prepare a bank statement (with logo, signature and stamp if it is a printed version; electronic versions must be printed, signed and stamped by the bank) covering the period from the date of the deposit (of these funds) to the current date and send it at [email protected] from the email linked to your account or to our support officer via live chat. It would be amazing if you could also provide us with an email of the bank representative (the person who provided you with the bank statement). We would then ask you to inform us as soon as you send it. You can contact us via live chat or by email ([email protected]). Please note that your bank statement must contain information about your bank card (the first 6 and 4 last digits of its number).

We will do our best to contact your bank and help them find the transaction. Your bank statement will be sent to the payment aggregator, and the investigation may take up to 180 business days.

If you withdraw an amount you deposited on the same day, these two transactions (deposit and withdrawal) will not be reflected on the bank statement. In this case, please contact your bank for clarification.

Do I need to provide any documents to make a withdrawal?

Yes. You need to verify your identity in order to withdraw funds. Account verification is necessary in order to prevent fraudulent financial transactions on the account.To pass the verification process, you will be kindly asked to upload your documents on the platform using the links given below:

1) A photo of your ID (passport, drivers license, national ID card, residence permit, refugee identity certificate, refugee travel passport, voter ID). You can use our video tutorials below for details.

2) If you used a bank card for depositing money, please upload a copy of both sides of your card (or cards if you used more than one to deposit) here. Please remember that you should hide your CVV number and keep visible the first 6 and the last 4 digits of your card number only. Please make sure that your card is signed.

If you use an e-wallet to deposit funds, you need to send us a scan of your ID only.

All the documents will be verified within 3 business days after you make a withdrawal request.

Withdrawal statuses. When will my withdrawal be completed?

1) After a withdrawal request is made, it receives the "Requested" status. At this stage, funds are deducted from your account balance.2) Once we begin processing the request, it receives the "In process" status.

3) Funds will be transferred to your card or e-wallet after the request receives the "Funds sent" status. This means that the withdrawal has been completed on our side, and your funds are no longer in our system.

You may see the status of your withdrawal request at any time in your Transactions History.

The time when you receive the payment depends on the bank, the payment system or the e-wallet system. It is approximately 1 day for e-wallets and usually up to 15 calendar days for banks. The withdrawal time could be increased by the payment system or your bank and IQ Option has no influence on it.

How long does it take to process the withdrawal?

For every withdrawal request, our specialists need some time to check everything and approve the request. This is usually no more than 3 days.We need to make sure that the person who makes a request is really you, so that nobody else can access your money.

This is necessary for the security of your funds, along with the verification procedures.

After that, there is a special procedure when you withdraw to a bank card.

You can only withdraw to your bank card the total amount deposited from your bank card within the last 90 days.

We send you the money within the same 3 days, but your bank needs some more time to complete the transaction (to be more precise, the cancellation of your payments to us).

Alternatively, you can withdraw all your profits to an e-wallet (like Skrill, Neteller, or WebMoney) without any limits, and get your money within 24 hours after we complete your withdrawal request. This is the fastest way to get your money.

Trading

I had a tie on Digital Options and I still lost my investment. Why was that?

Digital Options function differently from All-or-Nothing Options. In the case of Digital Options, you must select a Strike Price, which is the price the asset must break through to make your transaction profitable. If the opening value equals to the closing one, the trade will close at loss since the Strike Price is not reached.

How to start trading?

If you are using IQ Option platform for the first time and if you don’t have much experience, you can start with our video tutorials. You can train on your practice balance, and then continue trading with real funds. You can also find information about trading on the pages of IQ Option Blog.

How to trade All-or-Nothing Options?

All-or-Nothing options trading involves deciding whether the price of the underlying asset is going to increase or decrease. If you choose Call option: you get profit if the closing price is higher than opening price. If you choose Put option: you get profit if the closing price is lower than the opening price.However, if you have incorrectly predicted the price movement (upwards or downwards) of the underlying asset, you will incur a loss of 100% of your invested amount.

Call Option: closing price opening price

Put Option: closing price

This type of trading offers only two outcomes: you either get profit or lose your investment only.

It does not matter how significantly price changes. If the closing price will be equal to opening price, your initial investment into a deal will be returned back to your balance.

What is the best time to choose for trading?

The best trading time depends on your trading strategy and a few other factors. We recommend that you pay attention to the market schedules, since the overlap of the American and European trading sessions makes prices more dynamic in currency pairs such as EUR/USD. You should also follow market news that might affect the movement of your chosen asset. Its better not to trade when prices are highly dynamic for inexperienced traders who dont follow the news and dont understand why the price is fluctuating.

How to trade Digital Options?

Digital Options trading is similar to All-or-Nothing Options trading. The main distinctive feature is the profitability and the risks of each deal that depend on a manually chosen strike price on the right side of the chart.- Potential profit on Digital Options can be up to 900%. However, an unsuccessful trade will result in loss of the investment.

- The closer strike price is to the current price of the asset - the lower your risks and potential profit are

Note that digital options will expire-in-the-money only if the actual price is not identical to the strike one. For call options it should exceed the strike price by at least one pip, for put options it should fall behind the strike price by at least one pip.

What are the purchase time and the expiration time?

The chart shows two lines marking points in time. The purchase time is the white dotted line. After this time, you cant buy an option for the selected expiration time. The expiration time is shown by the solid red line. When the transaction crosses this line, it closes automatically and you take either a profit or a loss for the result. You can choose any available expiration time. If you have not opened a deal yet, both white and red lines will be moving together to the right to mark the purchase deadline for the chosen expiration time.

How many options can I buy per expiration?

We dont restrict the number of options you can buy for an expiration or an asset. The only limitation is in the exposure limit: if traders have already invested a large amount in the asset you have selected, the amount you invest is limited by this exposure limit. If you are working in an account with real funds, you can view the investment limit for each of the options on the chart. Click on the box where you enter the amount.

What is the minimum price of an option?

We want trading to be available to everyone. The minimum investment amount for today trading conditions can be found on the Company’s trading platform/website.

What are the profit after sale and the expected profit?

All-or-Nothing Options and Digital Options are only available to Professional Clients.As soon as you buy a Put or Call option, three numbers appear on the right top side of the chart:

Total investment: how much you have invested into a deal

Expected Profit: possible result of the transaction if the chart point at the expiration line ends up at the same place where it is now.

Profit after Sale: If it is red, it shows you how much of the invested amount you will lose your balance after sale. If it is green, it shows you how much profit you will get after sale.

Expected Profit and Profit after Sale are dynamic, as they change depending on several factors including current market situation, how close the expiration time is and the current price of the asset.

Many traders sell when they arent sure that the transaction will give them a profit. The selling system gives you the chance to minimize losses on doubtful options.

Why is Sell button (prescheduled option closing) inactive?

For All-or-Nothing options the Sell button is available from 30 minutes until expiration to 2 minutes until expiration.If you trade Digital Options, Sell button is always available.

What is OTC?

Over-the-counter (OTC) is a trading method that is available when the markets are closed. When trading OTC assets, you get quotes that are generated automatically on the brokers server in a way that maintains equilibrium between buyers and sellers.Every Friday at 21:00 and every Monday at 00:00 am (GMT time) IQ Option is switching from market trading to OTC trading and from OTC trading to market trading.

How to trade CFD instruments (Forex, Crypto, CFD)?

New CFD types available on the IQ Option trading platform include CFDs on stocks, Forex, CFDs on commodities and cryptocurrencies, ETFs.The trader’s goal is to predict the direction of the future price movement and capitalize on the difference between current and future prices. CFDs react just like a regular market, if the market goes in your favor then your position is closed In The Money. In case market goes against you, your deal is closed Out Of The Money. The difference between Options trading and CFD trading is that your profit depends on the difference between entry price and closing price.

In CFD trading there is no expiration time but you are able to use a multiplier and set stop/loss and trigger a market order if the price gets a certain level.

How does a multiplier work?

CFD trading offers the usage of a multiplier which can help a trader to control the position that exceeds the amount of money invested in it. The potential profitability (as well as risks) will also be magnified. Investing $100 a trader may get the return that is comparable to a $1000 investment. That’s the opportunity a multiplier can offer. However, remember that the same goes with potential losses as these would be multiplied as well.You will find the information here.

How to use Auto Close Settings?

Stop-loss is an order that a trader sets to limit the losses in a particular open position. Take-profit works in much the same way, letting a trader lock in profit when a certain price level is reached. You can set the parameters in percentage, amount of money or asset price: example. You will find the detailed information here.

How to calculate profit in СFD trading?

If a trader opens a long position, the profit is calculated according to the formula: (Closing price / Opening price - 1) x multiplier x investment. If a trader opens a short position, the profit is calculated according to the formula (1-closing price/opening price) x multiplier x investmentFor example, AUD / JPY (Short position): Closing price: 85.142 Opening price: 85.173 Multiplier: 2000 Investment: $2500 The profit is (1-85.142 / 85.173) X 2000 X $2500 = $1.819.82

What is the minimum investment to open a deal?

The minimum investment amount for todays trading conditions can be found on the Companys trading platform/website.

What is Slippage?

Please note that Slippage may occur when trading in CFDs. It is the difference between the expected price of an order and the price at which the order is actually executed. It can work either positively or negatively. It’s likely to occur during periods of higher volatility when market prices fluctuate very quickly. The situation can occur with either Stop Loss and Take Profit orders. general risk warning